Every week there is discussion about the Fed, and when they will interest rates or if they ever will raise rates. Here’s what I think.

Rates will eventually rise. Rates will eventually “normalized” levels. Wow, groundbreaking stuff Sherlock Holmes. More important than when it happens is what that means for investors.

Currently the interest rate yield curve is very flat, meaning that the difference or “spread” between short-term and long-term rates is small. When yield curves are flat, there is low incentive for banks to lend. Banks or we will just say lenders, make money by the difference (spread) between long-term and short-term rates.

As rates rise and the yield curve steepens, lending should increase which is good for the economy. Available capital should increase, which is good for the economy.

As the yield curve steepens financials will likely be attractive because banks as low interest short-term borrowers and high interest long-term lenders with be making more from the increased spread.

What about the overall market, isn’t the stock market only doing good because there is no alternative for investors? Won’t investors leave stocks when yields on bonds become more attractive? It is certainly possible, and I definitely expect a lot of volatility when the rate hikes do begin.

I think that overall investors will realize that stocks provide a higher probability of growth than bonds and will act accordingly. I do not believe a high percentage of investors look at stocks vs. bonds and think to themselves “I like stocks when rates are X, but when rates move to Y I am getting out completely out and moving to bonds.”

This week it was revealed that one of the reasons the Fed did not begin the forever coming rate hike was concerns over volatility in the market. At one of my previous firms we use to say “volatility is normal, and volatile.” That statement is still true today.

Volatility is always going to be present in equity markets. When that isn’t the case, we will all be looking somewhere else to get return on investment. Hopefully and likely, it will never come to that. Anything is possible, but that scenario is certainly not probable.

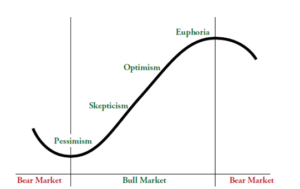

It is true that the current bull market has experienced unusually low volatility, considering the market hasn’t experienced a correction since 2011. The market typically whether it’s a bull or bear market has a correction every 12 months. I believe we are in the midst of a correction currently, but only time will time tell. I could always be wrong.

From 1928-2010 the S&P 500 averaged 61.9 days per year with a greater than a 1% swing. The median number of days over that period was 51.5 days.

We as investors should not want low volatility to continue, and we should not expect it to continue. We as investors need to embrace volatility and take solace in knowing that others are panicking and destroying their portfolios.

According to a chart by JP Morgan in their 4Q Guide to markets, the average investor returned an annualized 2.5% from 1994-2014. That is absolutely dreadful, over a period that saw the S&P annualized 9.9%.

Let’s not be in that 2.5% group, we are better than that.

– Wyatt Swartz

– 10/9/2015