A few weeks ago, I wrote a newsletter outlining the current mathematical challenge facing US stocks. To summarize: US stocks are unfavorably priced relative to history, US stocks are unfavorably priced relative to projected future earnings, and US stocks are unfavorably priced relative to bonds (& other fixed income securities).

Since that writing, stocks had significant declines with a strong rally this week.

Given circumstances, portfolio adjustments should be considered (in some cases already implemented). Any moves are designed to provide some level of defense should we see declines in stocks, but still capture the majority of the upside if markets rise.

This conversation is not relevant to all investors, or all investment accounts. Let’s establish where this is relevant.

- Taking Withdrawals or Nearing Time (Retired & near Retirement) – Investors consistently taking withdrawals or nearing the point they will be.

- Non-retirement Funds – Many investors have liquid, taxable investment accounts with different goals/objectives from their retirement funds.

- Market Fatigue – Markets went on positive tear 2009 to 2020, during which volatility remained low. The 2020s have been a much more challenging environment for investors. 2022 was especially hard for retired investors, because we experienced a bear market in stocks and bonds. Rather than putting the car in park, sometimes investors need to take the foot off the gas a little. Better to get there 5-minutes later, than not get there.

2009 to 2020 was a very strong period for stock returns, and it was a period of extremely low interest rates. This made fixed income assets generally unappealing and led to the term “TINA” when describing the market environment, which stands for: There Is No Alternative. The implication was that investors were either in stocks or not invested, because fixed income was not providing a meaningful return above cash.

The world is different now. Fixed income assets can give investors meaningful positive returns, while having much lower short-term volatility than stocks. One might say that the 60/40 portfolio is back! Wall Street has described the situation as a “TARA Market,” which stands for: There are reasonable alternatives. Over the long-term stocks will continue to have superior returns vs. fixed income assets, but they aren’t only game in town anymore.

Now if you are reading this, and my last newsletter and thinking “how can we play defense if stocks take another downward tumble,” then see our below.

- Increase Fixed Income Holdings – Meaningful returns with lower volatility.

- More Active vs. Passive Holdings – Active funds have been unfairly treated over the last ~15-years. While it is true that in any calendar year only about half of active funds outperform their stated benchmark, they do better when/if markets go down.

- Value/Dividends/Hedged – Owning stocks that are value priced, pay high dividends, or have some hedging mechanism may underperform broad indices in a rapidly rising market, but typically provide substantial cushion in down or flat markets. The goal here is to capture 60-80% of the upside, with only 40-60% of the downside.

Let me know if you have any questions. Talk soon.

Wyatt Swartz

Written November 3rd, 2023

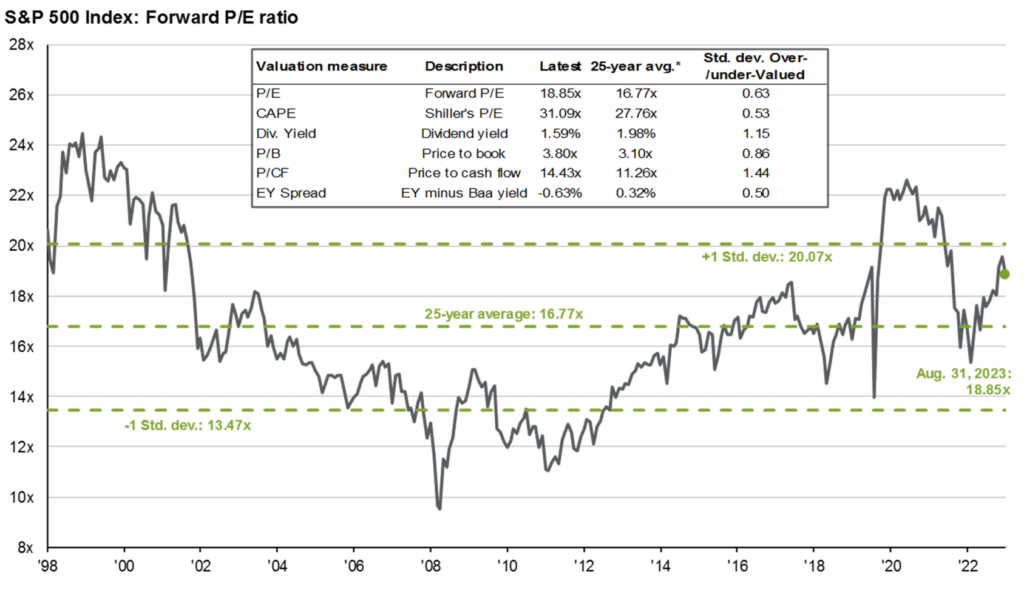

At around 4,516 (today the S&P closed at 4,259) the S&P 500 is priced at 18.86x forward earnings. As seen below, the 20-year average is 16.77x, and 20.07x would represent a full standard deviation above average.

The earnings per share forecast is about $240 for the S&P in 2024 as seen in the chart below.

When you compare prior year forecasts, you will find they tend to be slightly more optimistic than reality in times of economic expansion. However, when recessions occur EPS typically decline below prior forecast. The median decline for earnings during recessions is 13%. That would imply S&P earnings of $209/per share.

We cannot say if there will be a recession in 2024, or if there is, that EPS for the S&P 500 will actually fall by 13% below forecast.

Taking into account that the gravitational force of the market pulls it up over time, we should still ask three questions regarding the US stock market.

- Do we believe markets will mean revert back to historical ratios of price to earnings?

- What is the probability for US recession in 2024?

- If recession occurs in 2024, what do we expect EPS to be for the S&P 500 compared to our $240 forecast.

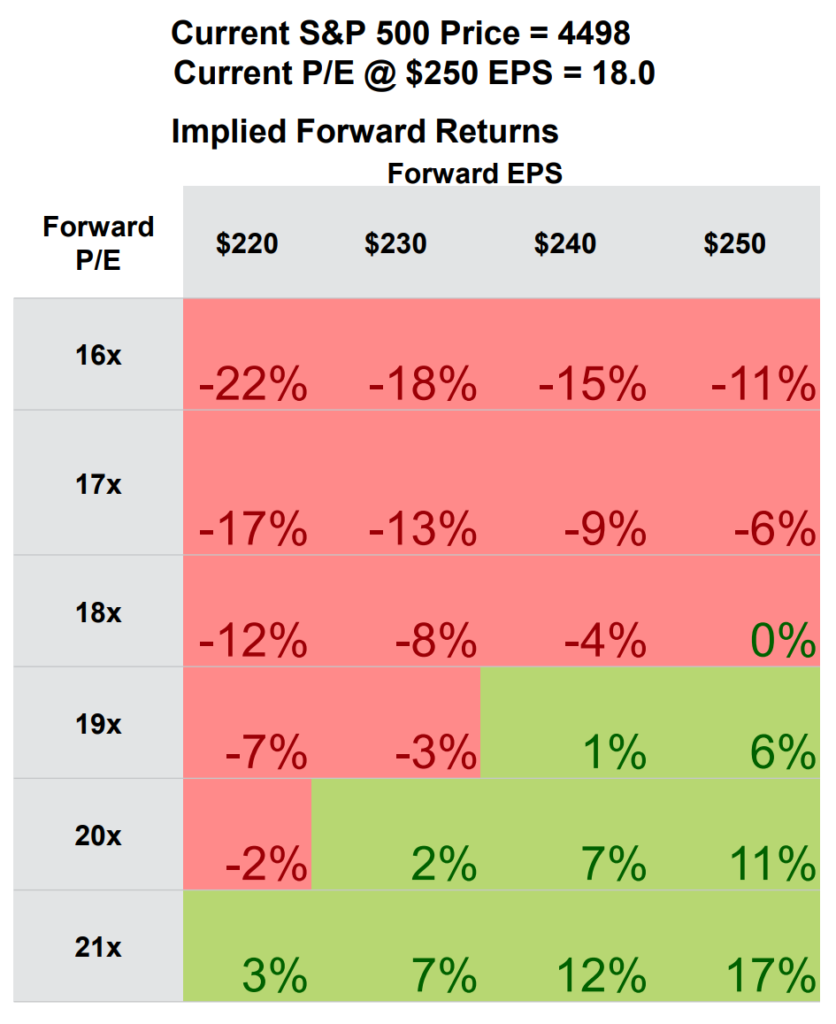

I call the above chart, “choose your level of optimism.” It shows that at a ~4500 starting point, if EPS were $250, and 18x P/E held true there would be a 0% gain. From there you can adjust to see the implied return based on EPS and P/E.

Example, if you expect $230 EPS, and for P/E to come down to 17x the implied return would be -13% (with 4500 as starting point, today’s level = 4258). I must apologize for outdated data; US stocks have fallen about 5% from mid-September when I started writing this. While the data is somewhat lagging, the concepts remain pertinent.

Markets of course are not as rational as the math I’ve presented above. There are many other forces that will impact the markets beyond the mathematics.

Thankfully, there are a number of attractive options for investors concerned with the math in US stocks. Please reach out if you would like to discuss.

To the W. Swartz & Co. private clients, I hope to send out an email next week summarizing actions we are taking to hedge against downside forces while continuing to participate in upside gains.

Sincerely,

Wyatt Swartz

Written October 5th, 2023

On August 1, Fitch, a credit ratings agency, downgraded the U.S. debt from AAA (the highest rating) to AA+. Fitch had warned of a possible downgrade during the debt ceiling crisis earlier this year and has sounded alarms since 2011 when a similar crisis occurred. Most do not see the downgrade as meaningful, AA+ still represents an extremely low default risk, that does not mean it has not impacted capital markets. What drove the downgrade of the U.S. debt and how can long-term investors maintain a balanced perspective?

The national debt is rightfully a source of investor worry but this has been the case for decades. While I would argue the downgrade is warranted, the puzzling nature of this is related to timing.

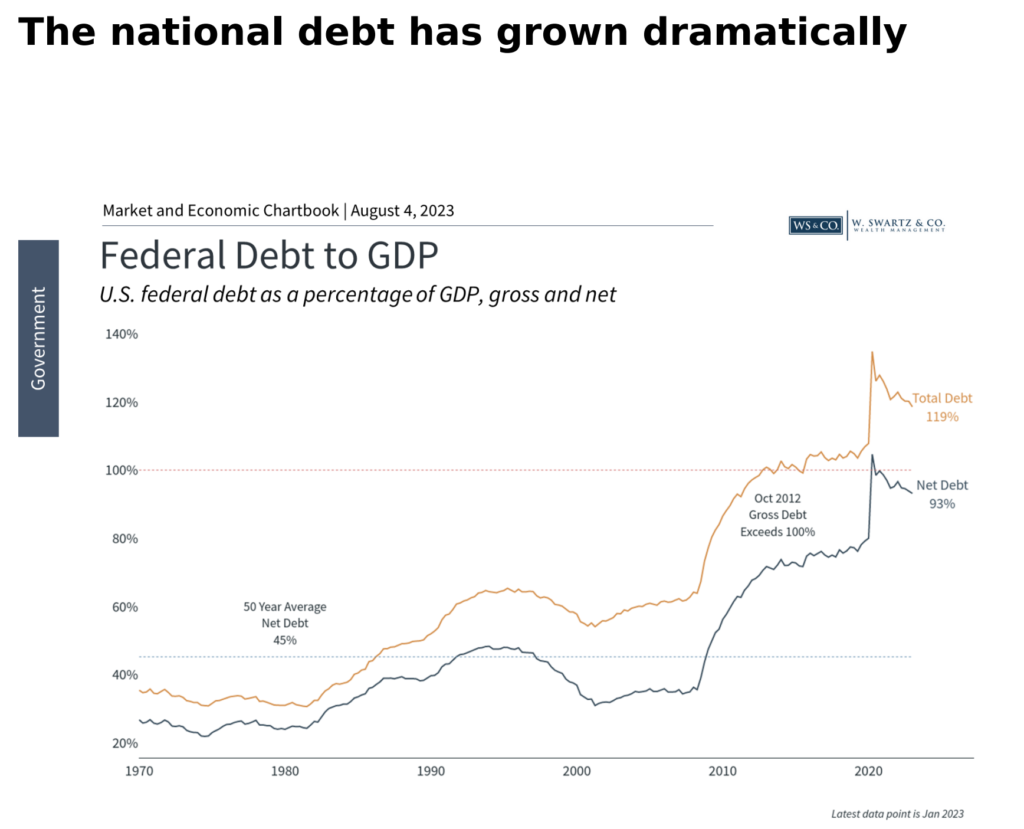

It’s no secret that the level of the national debt has grown considerably in recent years, from $9 trillion in 2008 to over $31trillion today. As a percentage of GDP, debt levels have risen to nearly 120% in total and 93% if inter-governmental debt holdings are excluded (i.e., debt one part of the government owes to another). Regardless of how you slice it, debt levels have risen dramatically with little end in sight.

Unfortunately, there are few examples of the federal government running surplus. This last occurred during the dot-com boom, before that, in the early 1970s during Nixon’s administration.

The U.S. now has ratings of AAA from Moody’s, AA+ from Standard & Poor’s, and AA+ from Fitch. Only nine countries, plus the European Union, maintain the top ratings across the three major credit ratings agencies, including Germany, Switzerland, Australia, and Singapore.

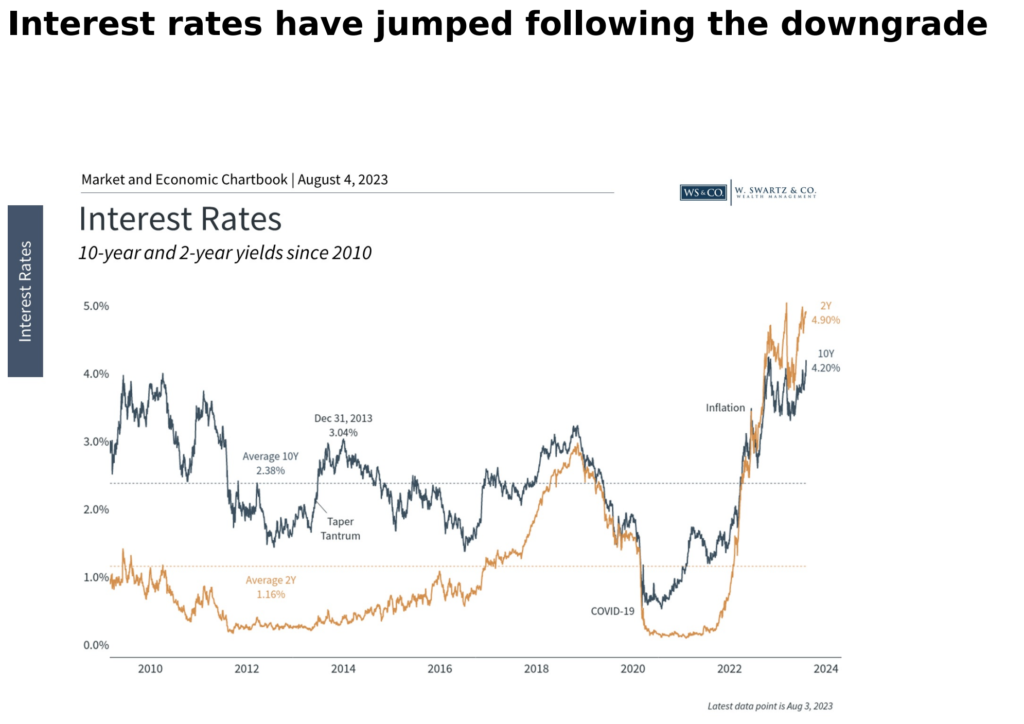

Why does this matter? Despite periods of brinkmanship, the U.S. has never defaulted on its debt. Meaning that the US Gov. has always paid its debts with any agreed upon interest. Albeit with devalued dollars in most cases post 1908. The global financial system is built on the premise that Treasuries are unquestionably “risk-free.” While the situation is still evolving, the immediate impact of the downgrade has been higher interest rates.

There are some parallels to the summer of2011, almost exactly 12 years ago to the day, when Standard & Poor’s was the first credit ratings agency to downgrade the U.S. debt.

During that period, the US stock market fell into correction territory with the S&P 500 declining19%. Ironically, the prices on Treasury securities increased during the 2011 debt ceiling crisis because, even though these were the exact securities being downgraded, investors still believed they were the safest in the world at a time of heightened uncertainty. The debt ceiling was eventually raised, and a new budget was approved. Markets eventually bounced back and reached new all-time highs only six months later. At the time, the market reaction was not only difficult to predict, but was unintuitive to many.

So, what does the latest U.S. debt downgrade mean for investors? In truth, nothing has changed in recent weeks regarding the health of the economy or the long-term fiscal situation for the country. This is a symbolic move by Fitch, an appropriate move, but still symbolic.

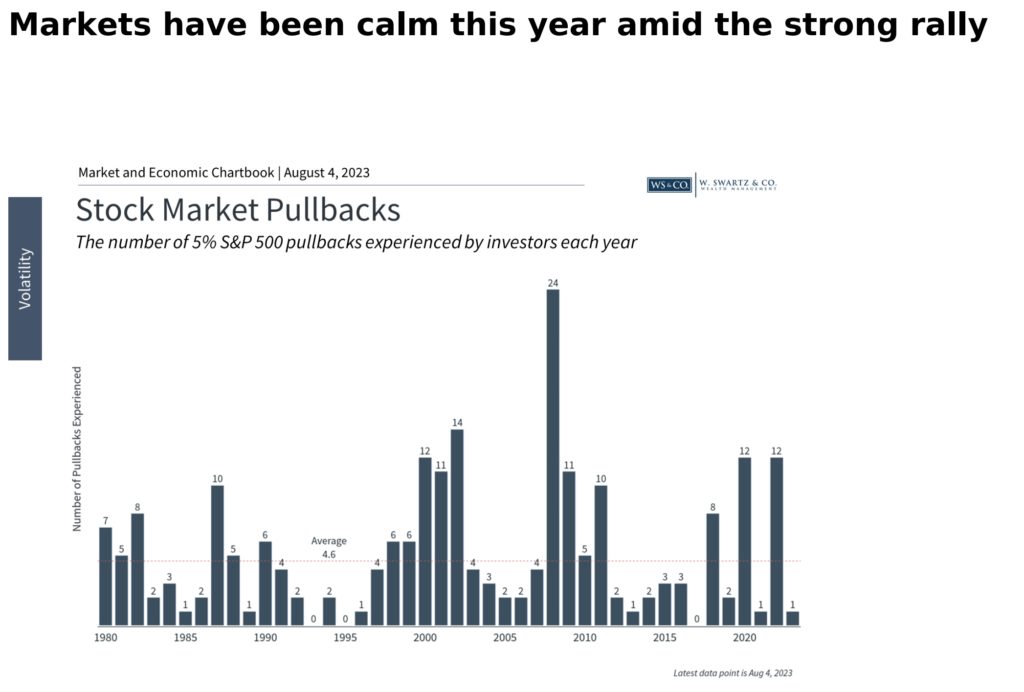

The accompanying chart shows that there has only been one pullback of 5% or worse this year which occurred in March during the Silicon Valley Bank, and Signature Bank failures, compared to the average year which experiences several.

Two long-term debt concerns that some investors often have are the growing interest payments on the national debt and the reliance on foreign borrowing. Neither has a simple solution. The fact that interest rates have been and remain relatively low compared to history has helped to keep these payments manageable. When it comes to our foreign dependency, over 75%of the U.S. debt is still held by American households and institutions, compared to foreign holdings of 3.5% by Japan, 2.7% by China, 2.1% by the U.K., and so on.

The national debt and the fiscal standing of the U.S. matter for many reasons. But from an investment perspective, the irony is that the best times to invest have been when the deficit has been the worst. These periods coincide with the most attractive prices and valuations. Ultimately, history shows that investors are rewarded for investing when others are fearful.

The bottom line? Although the Fitch downgrade is impacting markets, it is based on factors with which investors are already familiar. Fitch is acknowledging the fact that the US Gov. is unlikely to pay its debts without creating more inflation. While inflation is negative for most capital investments in the short-term (see 2022), over the long-term stocks benefit from inflation. Corporations are nimble and their profits, dividends, revenues, prices, etc. all go up to reflect the new value of money in real terms. The same is true for share prices.

Sincerely,

Wyatt Swartz

Written August 4th, 2023