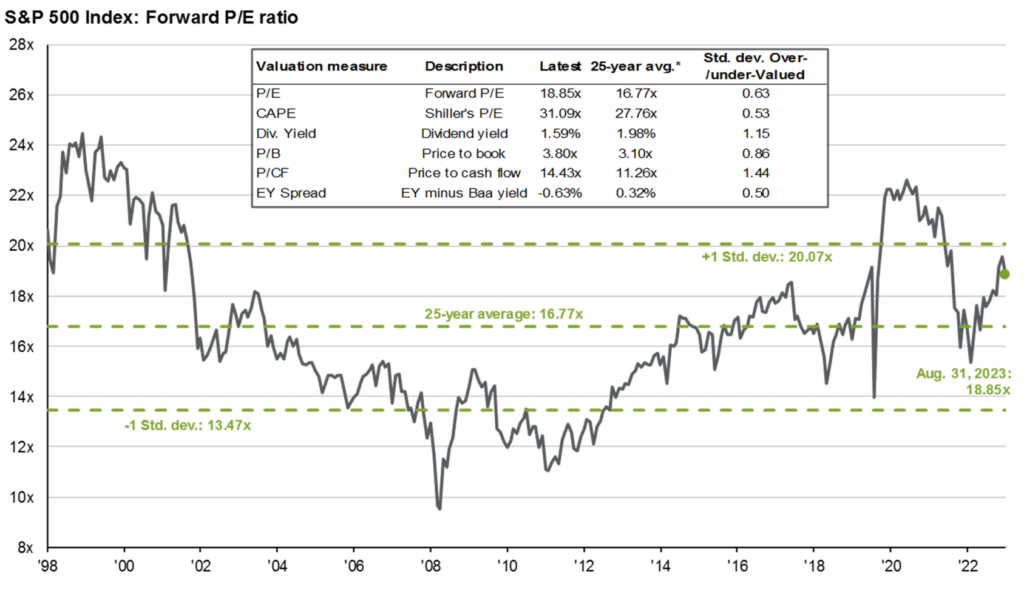

At around 4,516 (today the S&P closed at 4,259) the S&P 500 is priced at 18.86x forward earnings. As seen below, the 20-year average is 16.77x, and 20.07x would represent a full standard deviation above average.

The earnings per share forecast is about $240 for the S&P in 2024 as seen in the chart below.

When you compare prior year forecasts, you will find they tend to be slightly more optimistic than reality in times of economic expansion. However, when recessions occur EPS typically decline below prior forecast. The median decline for earnings during recessions is 13%. That would imply S&P earnings of $209/per share.

We cannot say if there will be a recession in 2024, or if there is, that EPS for the S&P 500 will actually fall by 13% below forecast.

Taking into account that the gravitational force of the market pulls it up over time, we should still ask three questions regarding the US stock market.

- Do we believe markets will mean revert back to historical ratios of price to earnings?

- What is the probability for US recession in 2024?

- If recession occurs in 2024, what do we expect EPS to be for the S&P 500 compared to our $240 forecast.

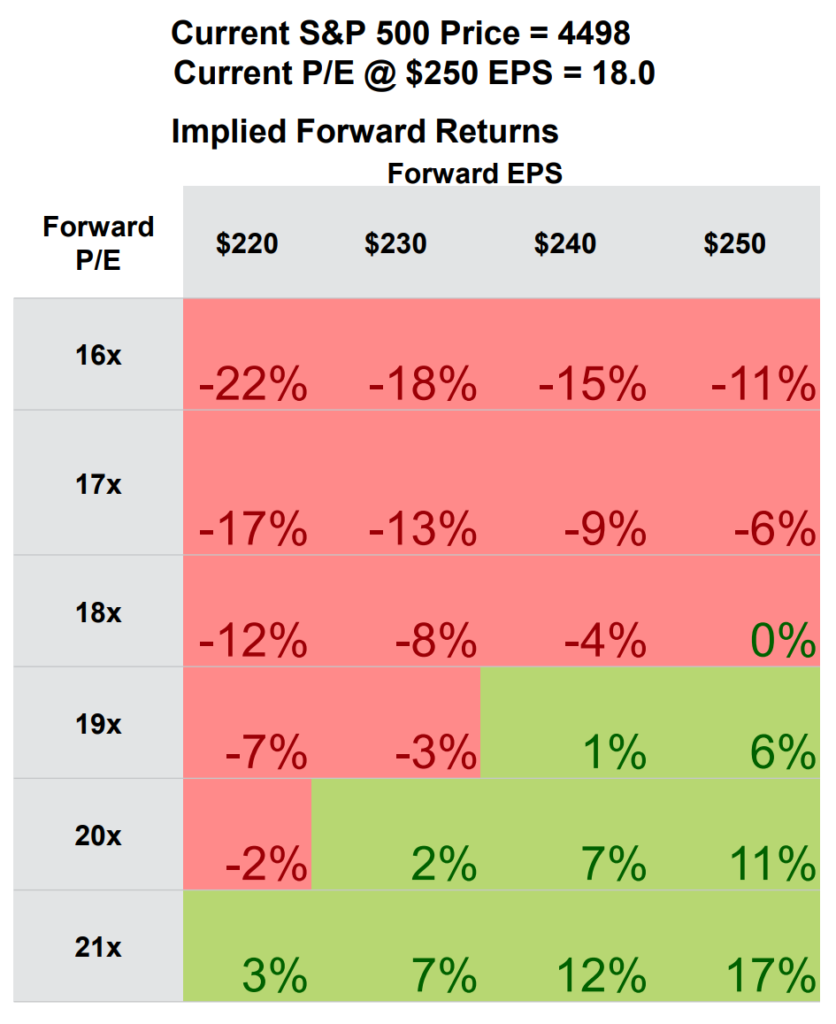

I call the above chart, “choose your level of optimism.” It shows that at a ~4500 starting point, if EPS were $250, and 18x P/E held true there would be a 0% gain. From there you can adjust to see the implied return based on EPS and P/E.

Example, if you expect $230 EPS, and for P/E to come down to 17x the implied return would be -13% (with 4500 as starting point, today’s level = 4258). I must apologize for outdated data; US stocks have fallen about 5% from mid-September when I started writing this. While the data is somewhat lagging, the concepts remain pertinent.

Markets of course are not as rational as the math I’ve presented above. There are many other forces that will impact the markets beyond the mathematics.

Thankfully, there are a number of attractive options for investors concerned with the math in US stocks. Please reach out if you would like to discuss.

To the W. Swartz & Co. private clients, I hope to send out an email next week summarizing actions we are taking to hedge against downside forces while continuing to participate in upside gains.

Sincerely,

Wyatt Swartz

Written October 5th, 2023