Despondent: in low spirits from loss of hope or courage

In 1985, the super welterweight champion Thomas “Hitman” Hearns moved up in weight to fight middleweight champion Marvin Hagler. The match was billed as “The Fight” and it lived up to the moniker. It’s typically considered the best three rounds in boxing history. It was nonstop action and drama.

Coming into the bout, Hearns was known to have a knockout righthand punch. It was his ace in the hole that when landed cleanly would drop opponents.

From the onset, Hagler relentlessly and aggressively stalked Hearns, forcing action. Hagler’s pace turned the boxing match into a brawl. In doing this he opened himself up to Hearns’ knockout punch.

On que, Hearns landed his trademark straight righthand, but it did not have its previous effect. Hagler kept relentlessly coming. Despondent after throwing his best punch to no avail, Hearns was knocked out in the third round and carried out of the ring by members of his entourage.

Last week, stocks had a strong couple of days, but to no avail. They have since given those gains back and found new lows, again. At the start today (10/12/2022), global stocks were -25.53% year-to-date.

While markets were positive in 2021 on a calendar year basis, the bulk of the positive returns occurred in the first quarter. Taking that into account, stocks have had a hard go for quite a while.

There is a story in every boxing match and a story in every market. Last week’s market rally might have been a Hearns’ righthand punch.

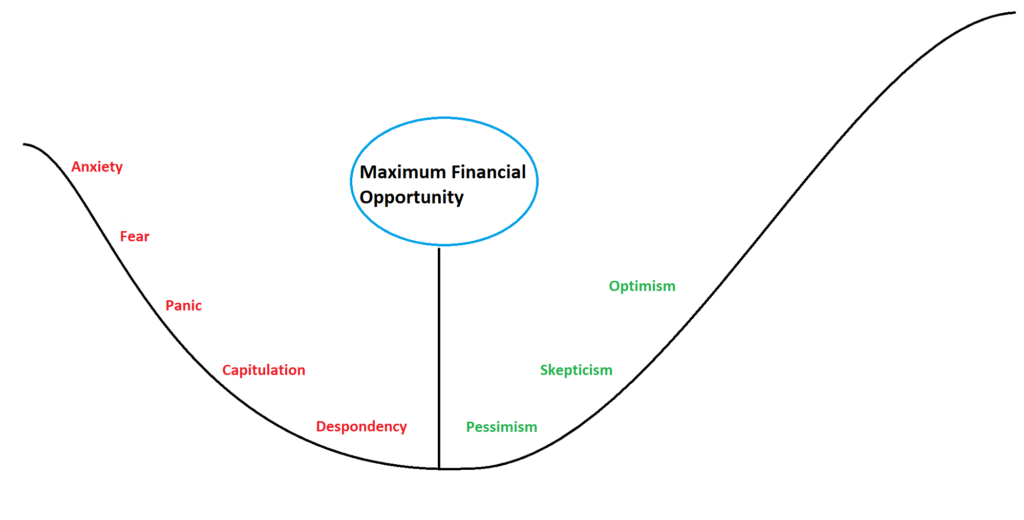

Boxing matches come to an end, but markets are perpetual lifecycles of death and rebirth. If investors are despondent, and markets are capitulating, then the death of this bear market is near.

Early last month, I wrote a Newsletter outlining the short-term headwinds against markets. This week Jamie Dimon, longtime CEO of JP Morgan recently painted a bleak outlook for stocks and the US economy.

I am speaking with investors daily, and would frame their sentiment anecdotally as very despondent. Lately, media has started to echo the sentiment of my investor conversations.

This intersection between investor sentiment and media is the biggest positive indicator since the start of the year, and it has me truly excited as an investor.

It’s easy to look back on 2000 and 2008 and see the great opportunity investors had, but capitalizing on it in the moment is hard.

“To buy when others are despondently selling… requires the greatest fortitude and pays the greatest reward.” Sir John Templeton

I am positioning portfolios to take advantage of the inherent opportunities and eventual rebirth of this market.

What are your thoughts on markets, economy, inflation, etc.? I’d love to hear.

Written – 10/12/2022

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com