2022 was a dreadful year for investors. I think most investors are acutely aware of the ~recent pains occurring in capital markets. However, I venture to guess most are unaware of the how unique and truly rare the year was.

US stocks, international stocks, and the US aggregate bond market were all negative for the year.

- US Stocks -18.14%

- International DM Stocks -14.27%

- US Investment Grade Bonds -13.06%

Going back to 1980, there were ZERO calendar years where the broad US stock & bond market both had negative returns. The last time this occurred ~might have been in 1969. I say might, because I do not have perfect apples to apples data going back that far. At any rate, we experienced an extraordinarily rare year in capital markets, a year unlike any in at least 53 years.

There is value in understanding and remembering how rare last year was when creating a forward looking investment outlook. However, it would be a grave mistake to take the recent pains and extrapolate similar results over future short and long-term periods.

With that, let’s move the conversation to our outlook.

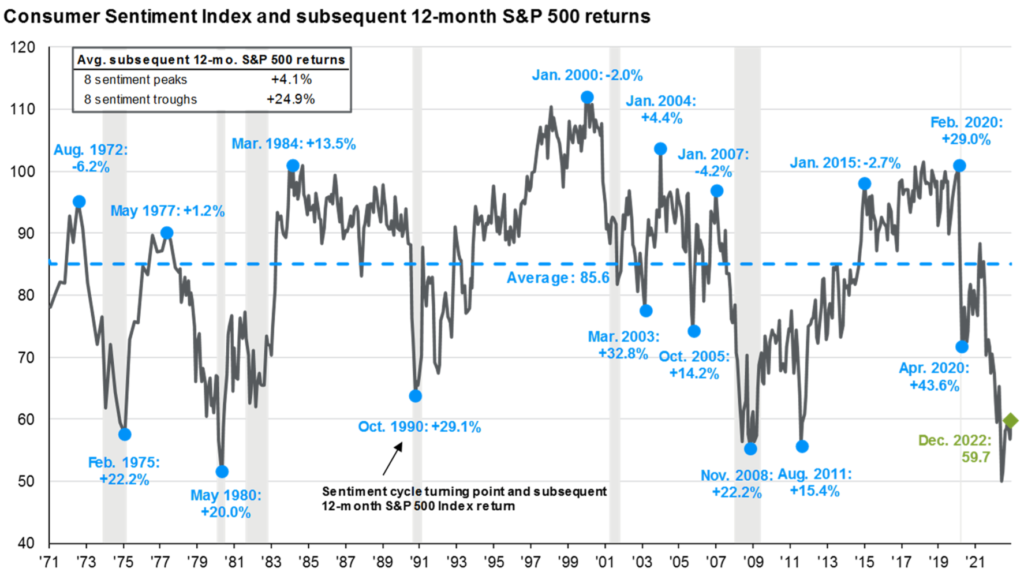

The combination of negative market performance and a slowing economy has investors understandably negative. However, as I outlined in a previous newsletter, despondent sentiment typically precedes strong market performance. Below you can see that troughing consumer sentiment is followed on average with +25% returns over following 12-month periods.

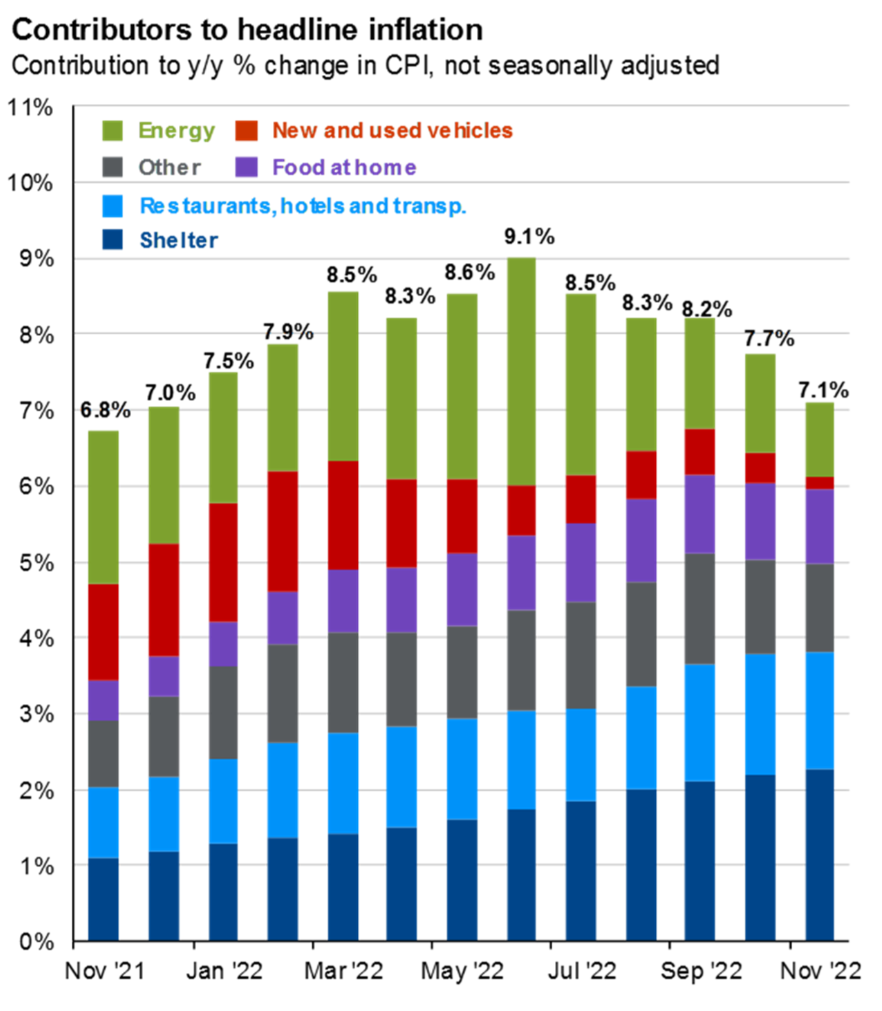

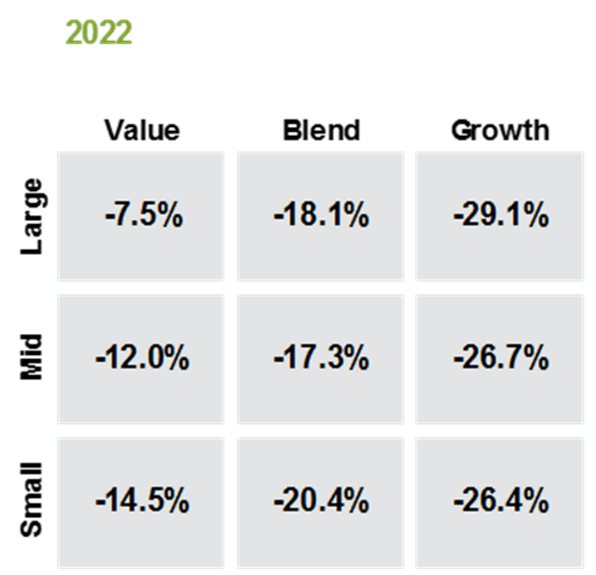

We are early stage of a period characterized by high but falling inflation. This will continue to favor dividend paying value stocks. I am happy to say WS&CO made a shift from neutral to value weighting within stocks going back to 4Q2021. Below you can see inflation numbers peaking last summer and slowly trending lower and the disparity between Value vs. Growth stocks investment returns in 2022.

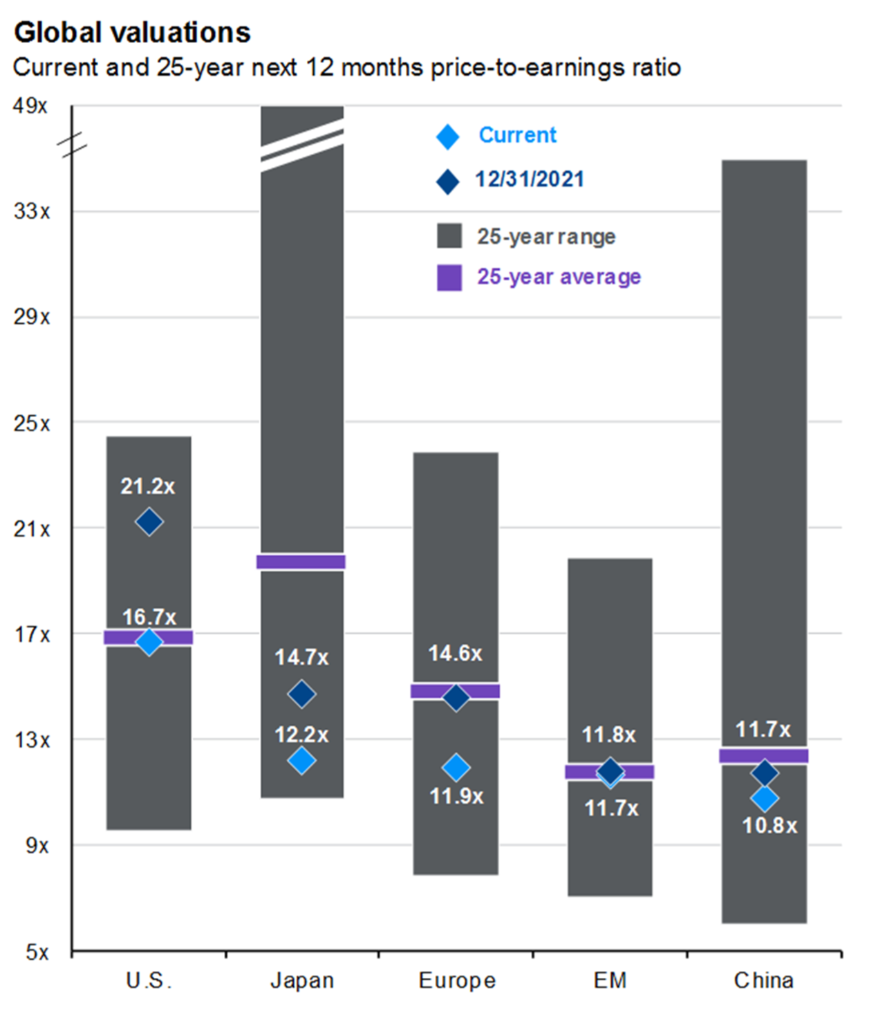

At the start of 2022 US stocks were pricey by historical measures. Today, US stocks are more attractively priced and international DM stocks are cheap by historical measures. This bodes well for stock returns moving forward, especially international stocks. Below you can see US stocks back in line with long-term averages for price-to-earnings as measured by the light blue diamond, and Japanese and European stocks well below historical averages.

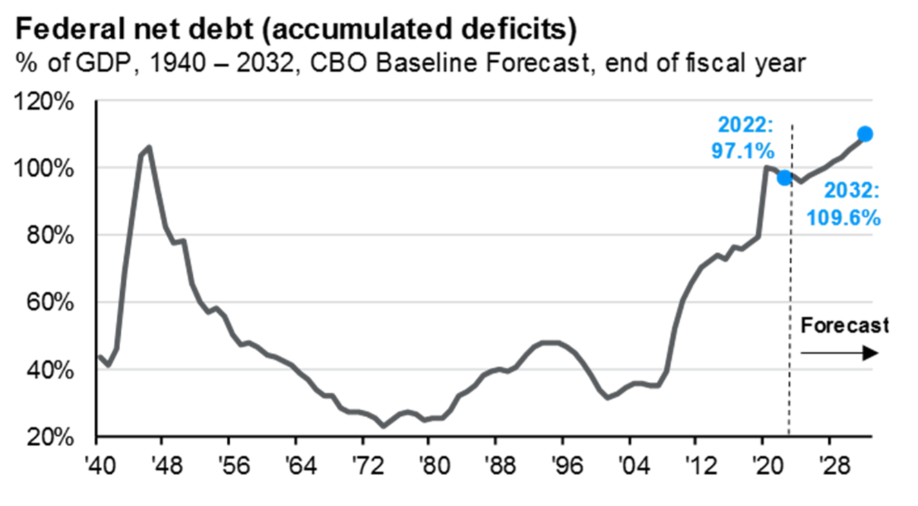

The combination of trade & budget deficits, rising government debt loads, and monetary tightening globally point to a weakening US dollar in both the short and long-term. A weakening US dollar is more rationale for diversification to international stocks. Below you can see Federal debt as percentage of US GDP at highest levels since the late 1940s, and the US dollar with strength comparable to when the US Gov. had a nearly balanced budget.

Falling inflation, a Fed pause to interest rate hikes, and a better starting point for asset prices should combine for a much better tasting cocktail in 2023. It would be unwise to expect rarities 2022 to continue indefinitely.

Any thoughts or questions? Please share, I’d love to hear them. Hope you had a wonderful holiday season, cheers to a new year!

Wyatt Swartz

Written January 11th, 2023