On August 1, Fitch, a credit ratings agency, downgraded the U.S. debt from AAA (the highest rating) to AA+. Fitch had warned of a possible downgrade during the debt ceiling crisis earlier this year and has sounded alarms since 2011 when a similar crisis occurred. Most do not see the downgrade as meaningful, AA+ still represents an extremely low default risk, that does not mean it has not impacted capital markets. What drove the downgrade of the U.S. debt and how can long-term investors maintain a balanced perspective?

The national debt is rightfully a source of investor worry but this has been the case for decades. While I would argue the downgrade is warranted, the puzzling nature of this is related to timing.

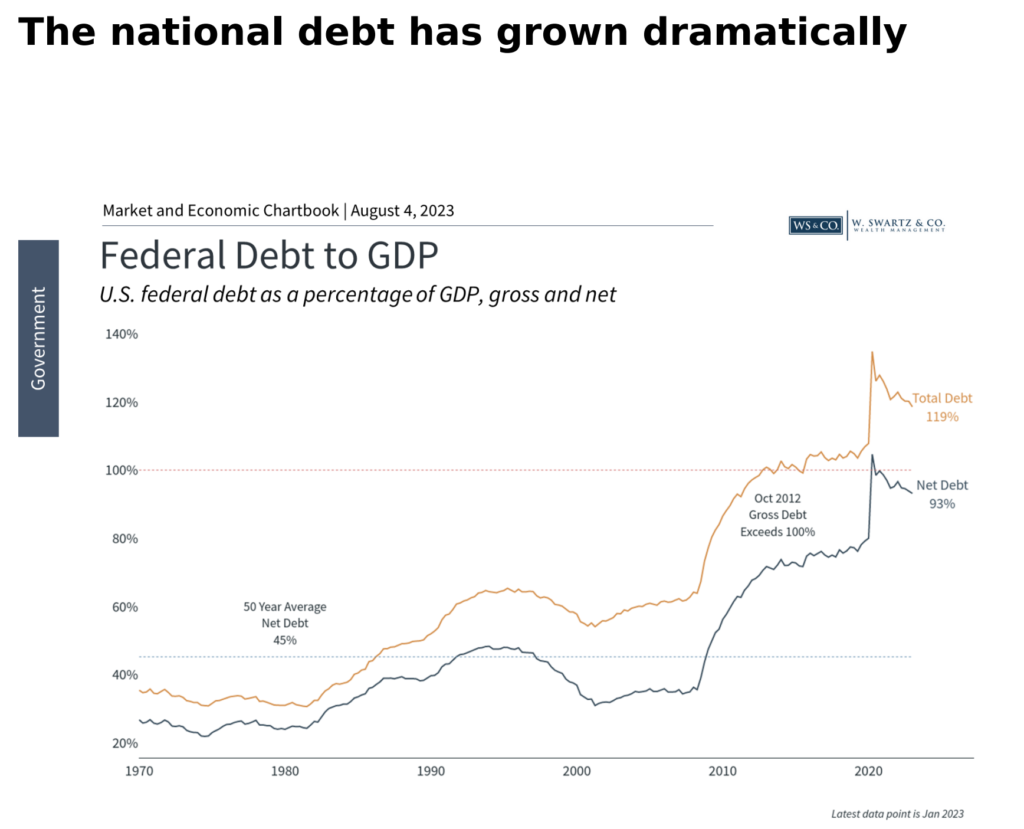

It’s no secret that the level of the national debt has grown considerably in recent years, from $9 trillion in 2008 to over $31trillion today. As a percentage of GDP, debt levels have risen to nearly 120% in total and 93% if inter-governmental debt holdings are excluded (i.e., debt one part of the government owes to another). Regardless of how you slice it, debt levels have risen dramatically with little end in sight.

Unfortunately, there are few examples of the federal government running surplus. This last occurred during the dot-com boom, before that, in the early 1970s during Nixon’s administration.

The U.S. now has ratings of AAA from Moody’s, AA+ from Standard & Poor’s, and AA+ from Fitch. Only nine countries, plus the European Union, maintain the top ratings across the three major credit ratings agencies, including Germany, Switzerland, Australia, and Singapore.

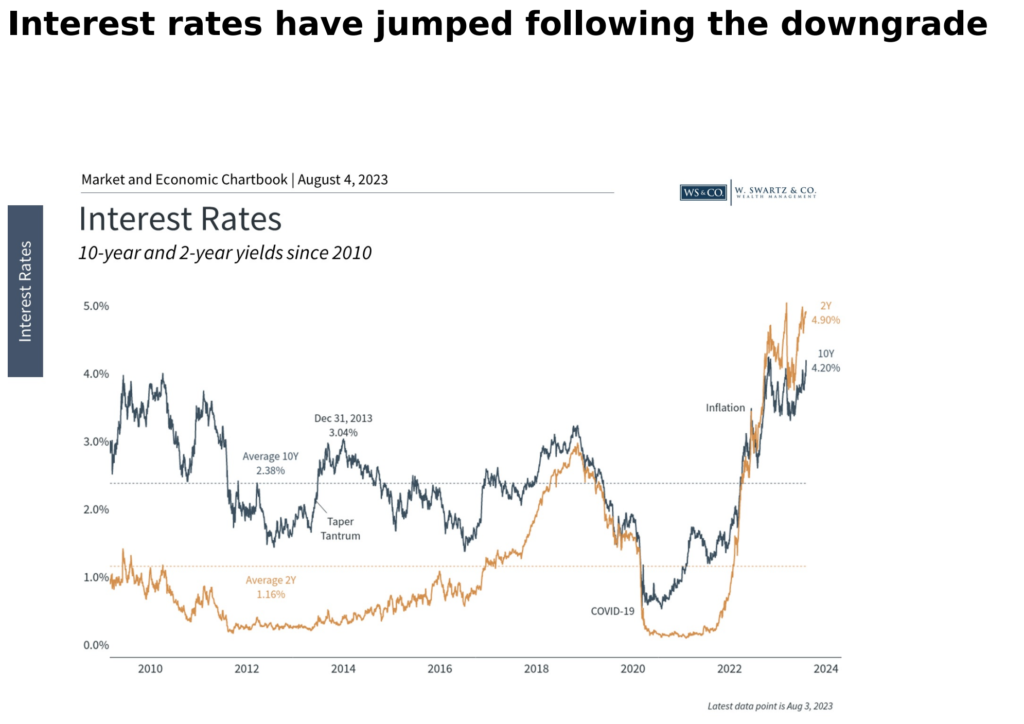

Why does this matter? Despite periods of brinkmanship, the U.S. has never defaulted on its debt. Meaning that the US Gov. has always paid its debts with any agreed upon interest. Albeit with devalued dollars in most cases post 1908. The global financial system is built on the premise that Treasuries are unquestionably “risk-free.” While the situation is still evolving, the immediate impact of the downgrade has been higher interest rates.

There are some parallels to the summer of2011, almost exactly 12 years ago to the day, when Standard & Poor’s was the first credit ratings agency to downgrade the U.S. debt.

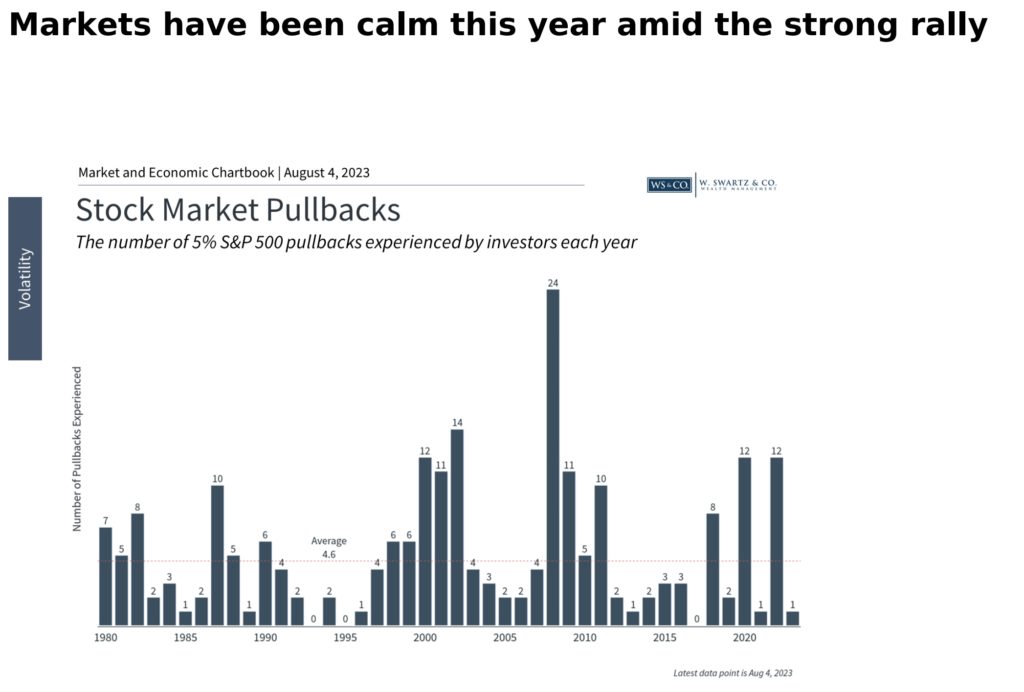

During that period, the US stock market fell into correction territory with the S&P 500 declining19%. Ironically, the prices on Treasury securities increased during the 2011 debt ceiling crisis because, even though these were the exact securities being downgraded, investors still believed they were the safest in the world at a time of heightened uncertainty. The debt ceiling was eventually raised, and a new budget was approved. Markets eventually bounced back and reached new all-time highs only six months later. At the time, the market reaction was not only difficult to predict, but was unintuitive to many.

So, what does the latest U.S. debt downgrade mean for investors? In truth, nothing has changed in recent weeks regarding the health of the economy or the long-term fiscal situation for the country. This is a symbolic move by Fitch, an appropriate move, but still symbolic.

The accompanying chart shows that there has only been one pullback of 5% or worse this year which occurred in March during the Silicon Valley Bank, and Signature Bank failures, compared to the average year which experiences several.

Two long-term debt concerns that some investors often have are the growing interest payments on the national debt and the reliance on foreign borrowing. Neither has a simple solution. The fact that interest rates have been and remain relatively low compared to history has helped to keep these payments manageable. When it comes to our foreign dependency, over 75%of the U.S. debt is still held by American households and institutions, compared to foreign holdings of 3.5% by Japan, 2.7% by China, 2.1% by the U.K., and so on.

The national debt and the fiscal standing of the U.S. matter for many reasons. But from an investment perspective, the irony is that the best times to invest have been when the deficit has been the worst. These periods coincide with the most attractive prices and valuations. Ultimately, history shows that investors are rewarded for investing when others are fearful.

The bottom line? Although the Fitch downgrade is impacting markets, it is based on factors with which investors are already familiar. Fitch is acknowledging the fact that the US Gov. is unlikely to pay its debts without creating more inflation. While inflation is negative for most capital investments in the short-term (see 2022), over the long-term stocks benefit from inflation. Corporations are nimble and their profits, dividends, revenues, prices, etc. all go up to reflect the new value of money in real terms. The same is true for share prices.

Sincerely,

Wyatt Swartz

Written August 4th, 2023