2022 was a dreadful year for investors. I think most investors are acutely aware of the ~recent pains occurring in capital markets. However, I venture to guess most are unaware of the how unique and truly rare the year was.

US stocks, international stocks, and the US aggregate bond market were all negative for the year.

- US Stocks -18.14%

- International DM Stocks -14.27%

- US Investment Grade Bonds -13.06%

Going back to 1980, there were ZERO calendar years where the broad US stock & bond market both had negative returns. The last time this occurred ~might have been in 1969. I say might, because I do not have perfect apples to apples data going back that far. At any rate, we experienced an extraordinarily rare year in capital markets, a year unlike any in at least 53 years.

There is value in understanding and remembering how rare last year was when creating a forward looking investment outlook. However, it would be a grave mistake to take the recent pains and extrapolate similar results over future short and long-term periods.

With that, let’s move the conversation to our outlook.

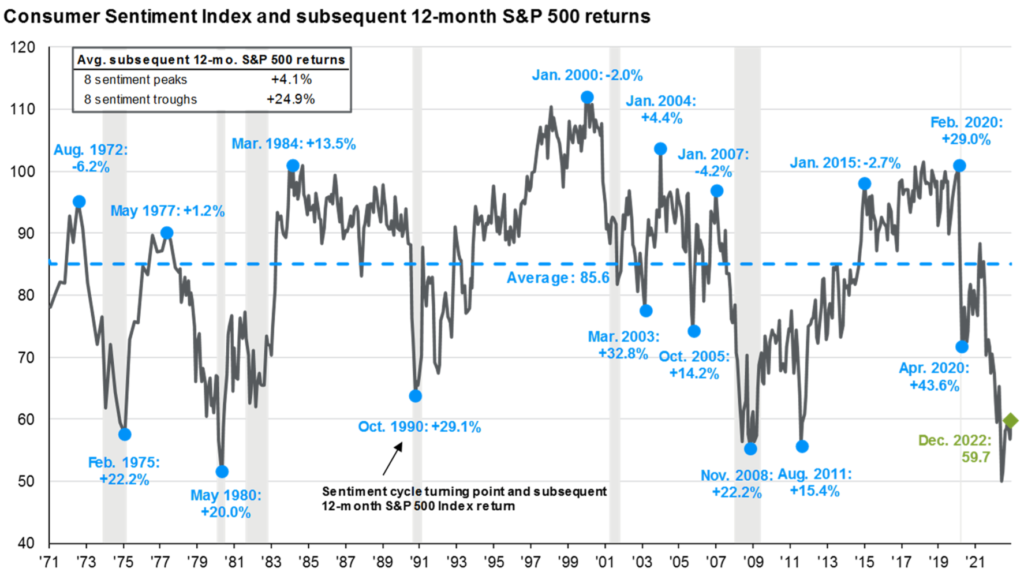

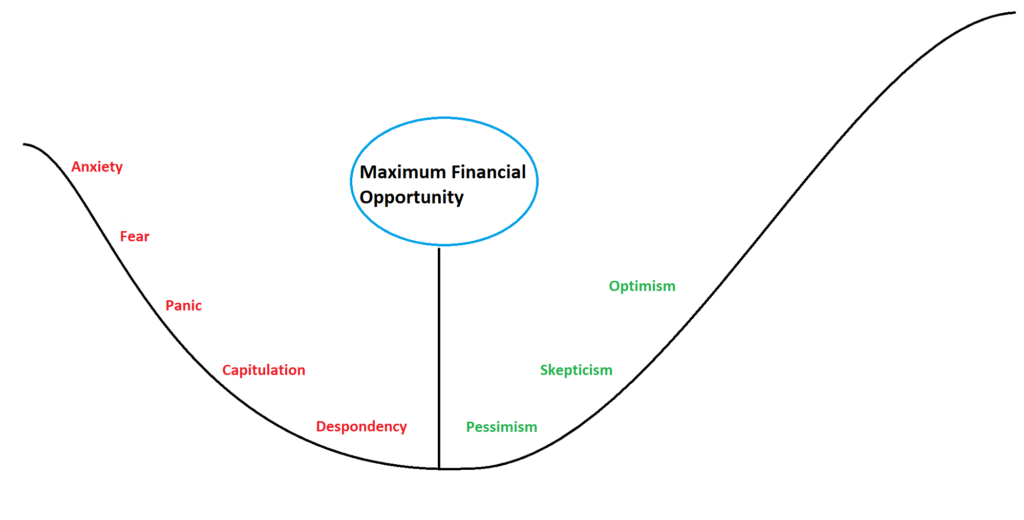

The combination of negative market performance and a slowing economy has investors understandably negative. However, as I outlined in a previous newsletter, despondent sentiment typically precedes strong market performance. Below you can see that troughing consumer sentiment is followed on average with +25% returns over following 12-month periods.

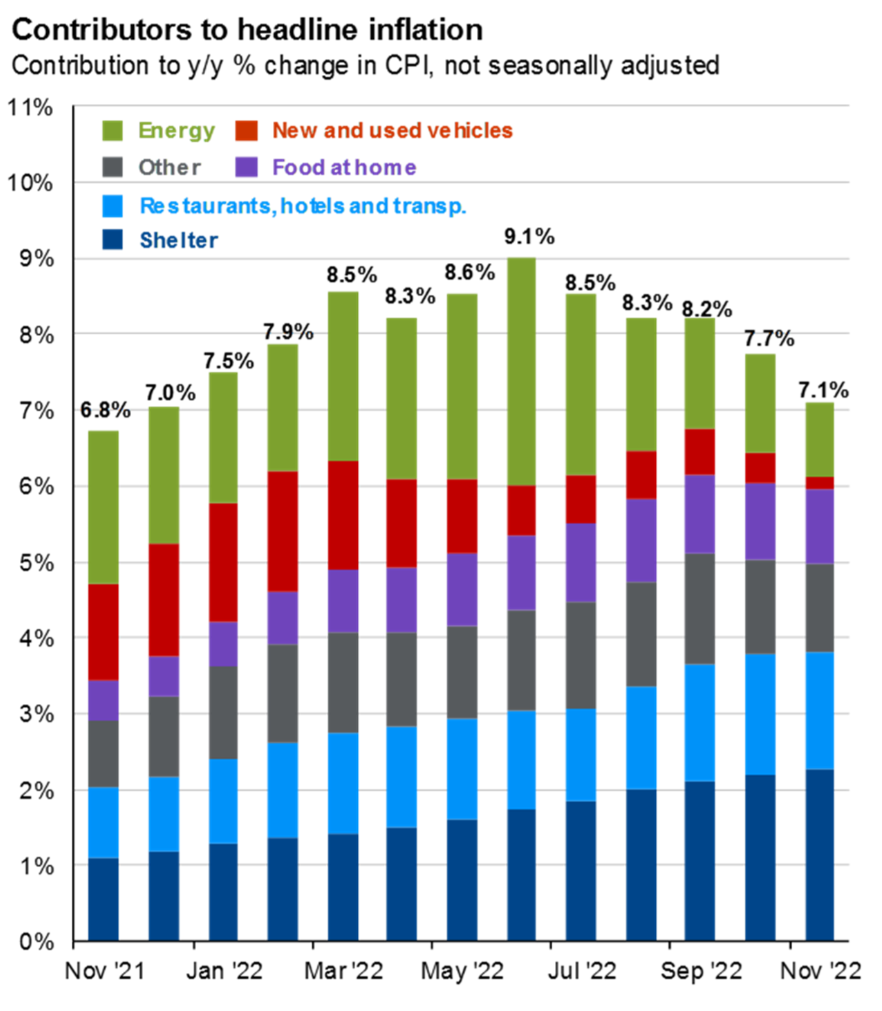

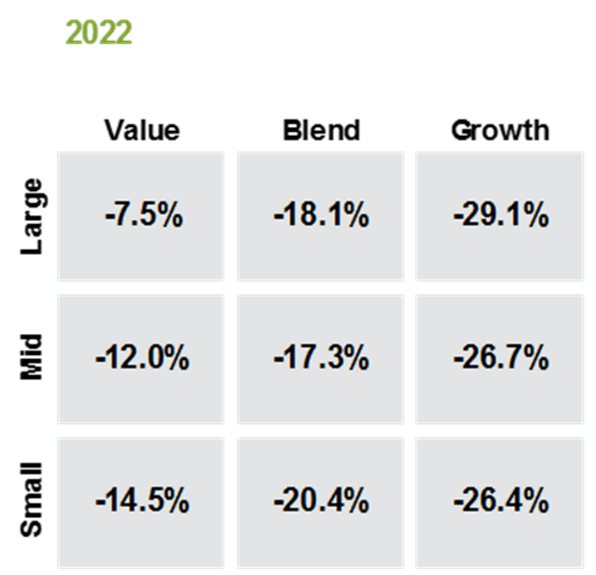

We are early stage of a period characterized by high but falling inflation. This will continue to favor dividend paying value stocks. I am happy to say WS&CO made a shift from neutral to value weighting within stocks going back to 4Q2021. Below you can see inflation numbers peaking last summer and slowly trending lower and the disparity between Value vs. Growth stocks investment returns in 2022.

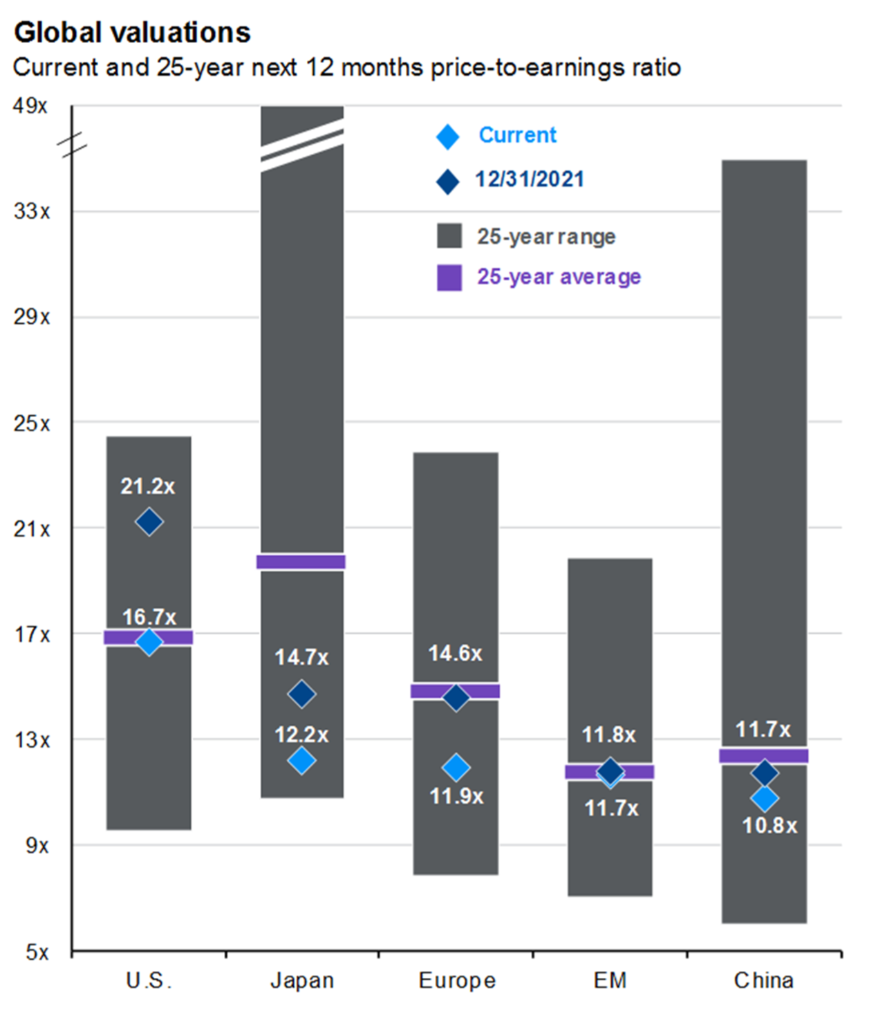

At the start of 2022 US stocks were pricey by historical measures. Today, US stocks are more attractively priced and international DM stocks are cheap by historical measures. This bodes well for stock returns moving forward, especially international stocks. Below you can see US stocks back in line with long-term averages for price-to-earnings as measured by the light blue diamond, and Japanese and European stocks well below historical averages.

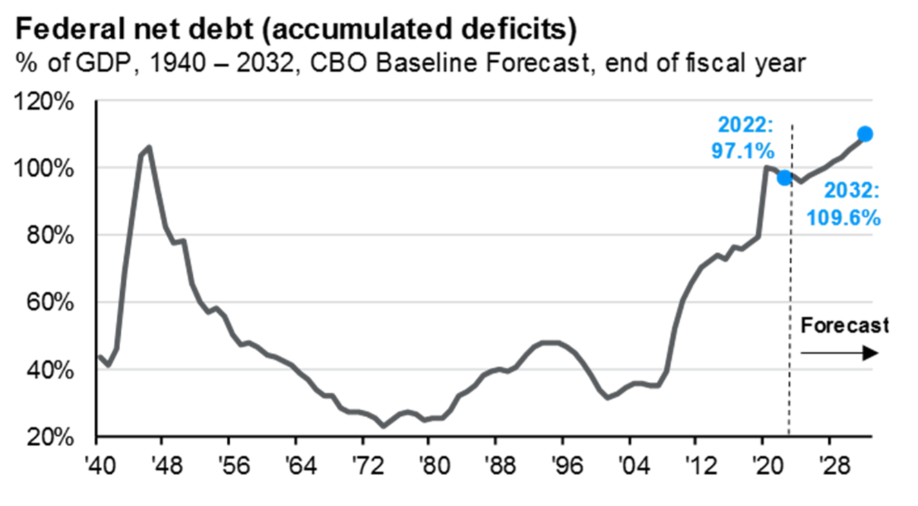

The combination of trade & budget deficits, rising government debt loads, and monetary tightening globally point to a weakening US dollar in both the short and long-term. A weakening US dollar is more rationale for diversification to international stocks. Below you can see Federal debt as percentage of US GDP at highest levels since the late 1940s, and the US dollar with strength comparable to when the US Gov. had a nearly balanced budget.

Falling inflation, a Fed pause to interest rate hikes, and a better starting point for asset prices should combine for a much better tasting cocktail in 2023. It would be unwise to expect rarities 2022 to continue indefinitely.

Any thoughts or questions? Please share, I’d love to hear them. Hope you had a wonderful holiday season, cheers to a new year!

Wyatt Swartz

Written January 11th, 2023

Despondent: in low spirits from loss of hope or courage

In 1985, the super welterweight champion Thomas “Hitman” Hearns moved up in weight to fight middleweight champion Marvin Hagler. The match was billed as “The Fight” and it lived up to the moniker. It’s typically considered the best three rounds in boxing history. It was nonstop action and drama.

Coming into the bout, Hearns was known to have a knockout righthand punch. It was his ace in the hole that when landed cleanly would drop opponents.

From the onset, Hagler relentlessly and aggressively stalked Hearns, forcing action. Hagler’s pace turned the boxing match into a brawl. In doing this he opened himself up to Hearns’ knockout punch.

On que, Hearns landed his trademark straight righthand, but it did not have its previous effect. Hagler kept relentlessly coming. Despondent after throwing his best punch to no avail, Hearns was knocked out in the third round and carried out of the ring by members of his entourage.

Last week, stocks had a strong couple of days, but to no avail. They have since given those gains back and found new lows, again. At the start today (10/12/2022), global stocks were -25.53% year-to-date.

While markets were positive in 2021 on a calendar year basis, the bulk of the positive returns occurred in the first quarter. Taking that into account, stocks have had a hard go for quite a while.

There is a story in every boxing match and a story in every market. Last week’s market rally might have been a Hearns’ righthand punch.

Boxing matches come to an end, but markets are perpetual lifecycles of death and rebirth. If investors are despondent, and markets are capitulating, then the death of this bear market is near.

Early last month, I wrote a Newsletter outlining the short-term headwinds against markets. This week Jamie Dimon, longtime CEO of JP Morgan recently painted a bleak outlook for stocks and the US economy.

I am speaking with investors daily, and would frame their sentiment anecdotally as very despondent. Lately, media has started to echo the sentiment of my investor conversations.

This intersection between investor sentiment and media is the biggest positive indicator since the start of the year, and it has me truly excited as an investor.

It’s easy to look back on 2000 and 2008 and see the great opportunity investors had, but capitalizing on it in the moment is hard.

“To buy when others are despondently selling… requires the greatest fortitude and pays the greatest reward.” Sir John Templeton

I am positioning portfolios to take advantage of the inherent opportunities and eventual rebirth of this market.

What are your thoughts on markets, economy, inflation, etc.? I’d love to hear.

Written – 10/12/2022

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com

September 1st, 2022, is looking like another red day for stocks. As I write this the global stock market is down -1.50% and the US stock market (S&P 500) is down -1.08%. The rally in markets following mid-June lows appears to be evaporating. Leading many, including me, to believe we have yet to hit bottom for this bear market.

Classic bear markets follow a pattern of low, but somewhat steady declines over the course of several months. Then a sharp pronounced cliff drop at the end, stocks hit bottom, and begin an new bull market expansion cycle.

However, sometimes we see “bear market rallies.” This occurs when stocks hit bear market levels (down -20%), rebound, and then fall again to lower lows than before. I find these prolonged bear markets to be more painful, even if the magnitude of the declines is less.

In the 2000 Bear Market stocks declined -23%, rebounded +11%, declined another -22%, rebounded +7%, and then fell another -30% before hitting bottom. The total magnitude of the drop was -45% from the prior peak. It was painful and unique not just because of the percentage decline, but because of the length of time it took to bottom. Stocks began their decline in March of 2000 and did not hit bottom until September 2002.

As I write, markets have been challenging to downright terrible for 14+ months. It is psychologically draining to investors (which might lead to a true bottom).

Looking at the market over the short-term, under ~14-months, it helps to think of it as a weighing machine for positive and negative forces.

Negative Market Forces:

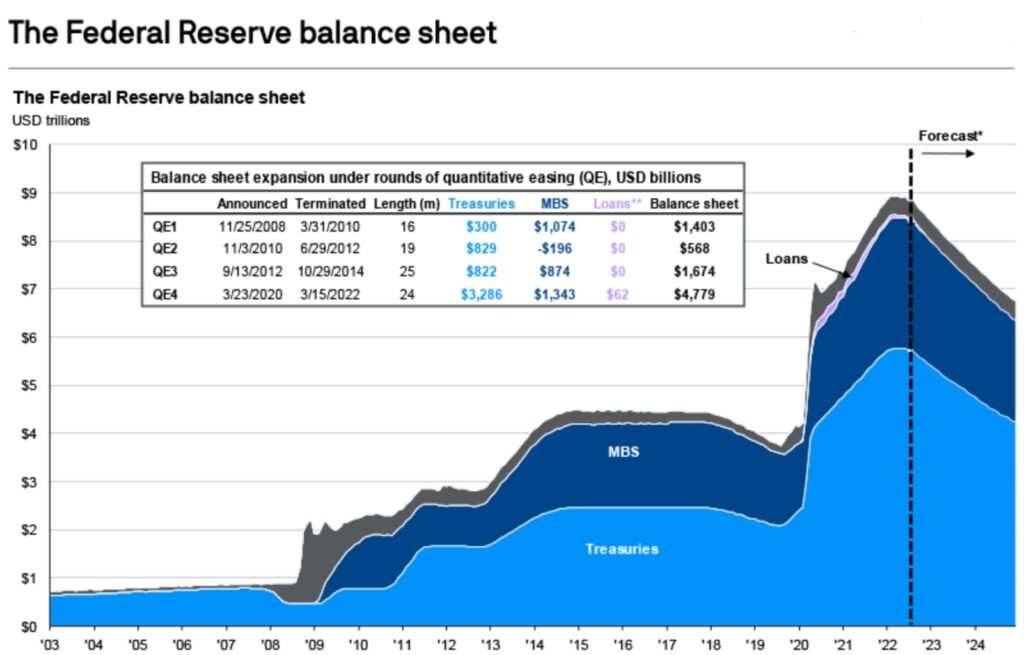

- Quantitative Tightening (QT) – Since 2008, the Federal Reserve (Fed) has been buying treasuries, and mortgage-backed securities. These purchases skewed the bond market and kept rates artificially low. As the Fed reduces and eventually stops purchases, the bond market will be free again. Rates should rise.

- Rising Rates – After spending over a year pretending there was no inflation, the Fed is trying to regain a shred of credibility by fighting inflation. Apart from QT, they are raising the Fed Funds Rate which effectively raises rates across the bond market.

- Recession & Earnings Revisions – The global recession is going to be a negative for markets until the data turns around. On top of macroeconomics, corporate earnings will probably be revised lower in 3Q.

- US Stock Valuations – Typically in bear markets, stocks bottom after they’ve reached cheap valuations. Starting the week US stocks were priced at 17x forward earnings. Lower earnings revisions will make stocks more expensive. My expecation is for stocks to hit 14x forward earnings (or lower) at bottom. That would mean prices have to come down, or earnings must go up. What do you think is more likely?

- Inflation – Over long-term periods inflation is a positive for stocks, becasue they are the only asset class that meaningfully provides significant ROI above the pace of inflation. In the short-term inflation is crippling for economies, and a negative force for markets.

Positive Market Forces:

- Stocks Go Up – At all times, broadly buying stocks is a sound investment long-term. The market is always long-term bullish. It is only a question of time. For that reason, investors should always have a bullish bias. Even today, as I’ve painted a dour picture for stocks in the short run, the probabilities of positive returns over the next 14+ months are very high.

Positioning investment portfolios requires knowledge of several factors that are unique to each individual investor.

That said, in my managed portfolios we favor value vs. growth stocks, we are tax-loss harvesting in taxable accounts, and using the green days in the market to reposition into a more defensive stance. We are holding a higher weighting to cash, and waiting for the inevitable bull market to come.

Wyatt Swartz

Financial Adviser, RIA

W. Swartz & Co.

(636) 667-5209 | www.wswartz.com