Skip to content

Last Friday, at midnight, the U.S. government shut down for the third time this year. This shutdown closed about a quarter of federal offices, and nine agencies have begun to implement contingency plans as the timing of any resolution remains uncertain. The inability to pass a bill which would continue to fund the government stemmed from a disagreement over funding for a wall on the border of the U.S. and Mexico, and recent reports out of Washington do not make it sound like policymakers are close to making a deal. While the direct impact on markets should be minimal, this shutdown does come in the wake of a particularly tumultuous week for the administration.

Recent history might suggest that a resolution will come quickly, but it is not clear how things will play out this time around. President Trump has been adamant that he will only agree to a plan which contains $5 billion in funding for the border wall, rejecting a bipartisan Senate agreement to fund the government until February at the end of last week. While some are calling for a rocky road ahead, and both houses of Congress have stated that they will not be coming back to Washington until December 27th, the Democrats will take control of the House on January 3rd. Importantly, this leaves only a few days to get a deal done before Congressional majorities change, which could encourage the Republicans to work quickly. There is the potential for the shutdown to drag into 2019, but there also seems to be room for a deal to emerge in the interim.

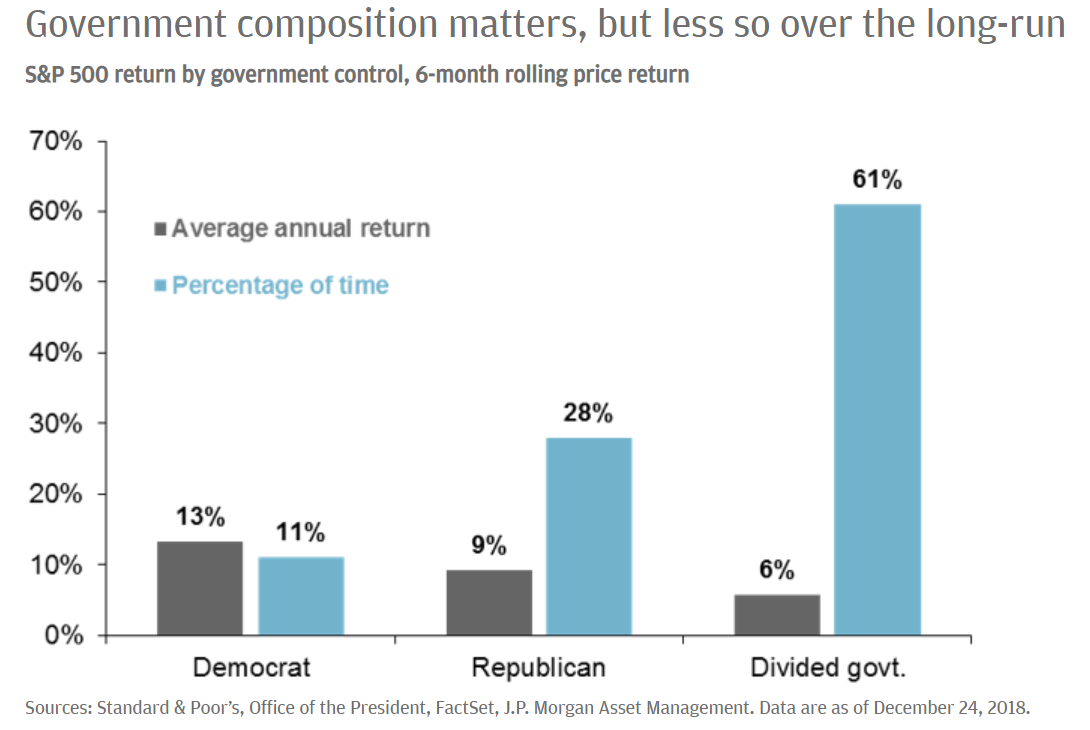

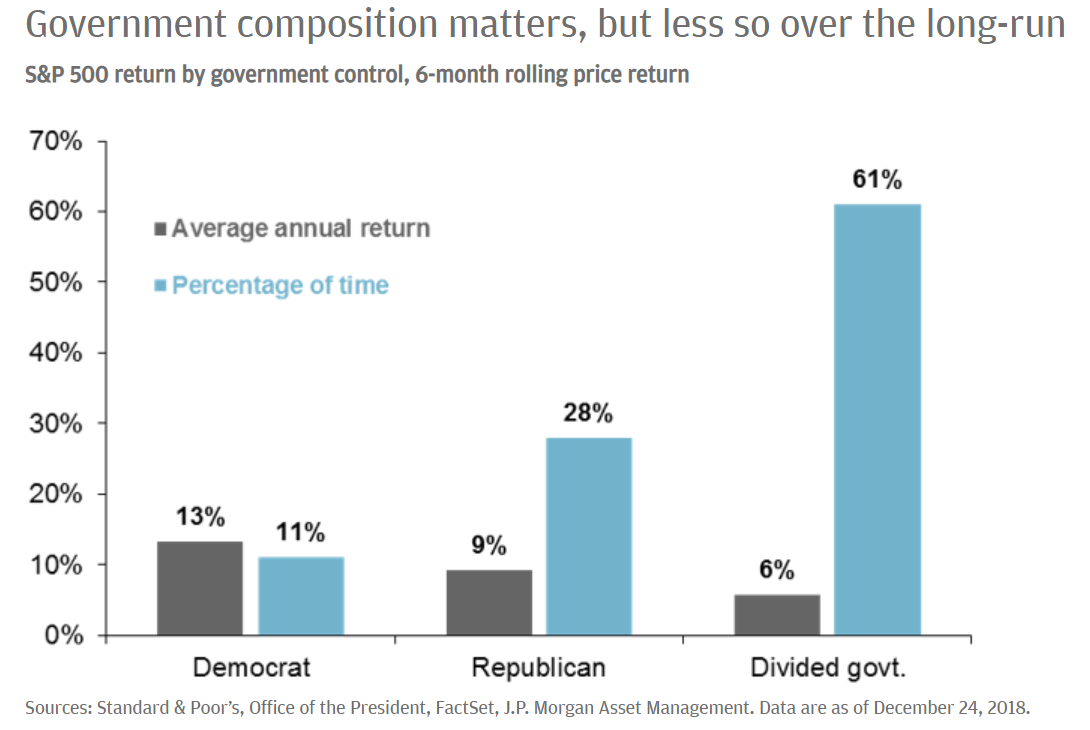

Markets have opened up in the red, reflecting lack of progress in Washington over the weekend, continued concerns about the trajectory of global growth, and the impact of further Fed tightening. It would not be surprising for market volatility to continue into the end of the year, and investors should be sure that portfolios are appropriately positioned for where we are in the cycle. That said, we do not see room for the shut down to have a significant impact on the trajectory of economic growth. Furthermore, as shown in the chart below, average equity market returns have been positive regardless of the composition of the U.S. government. The key at this juncture will be for investors to separate the signal from the noise, and avoid allowing emotion to dictate investment decisions.

David Lebowitz

12/24/2018

This article can be found here.